Payment Depot

About the brand

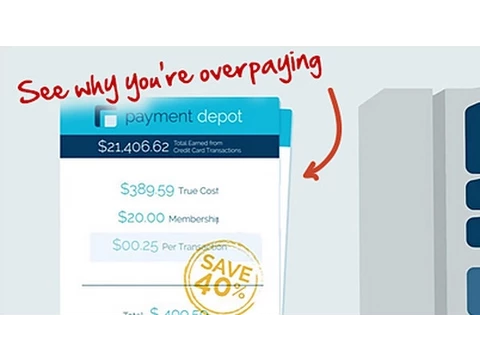

Payment Depot is a payment processor most known for its transparent, monthly pricing. It offers good features and strong customer support, and it’s best suited for businesses doing large amounts of sales volume.

Price

Ease of use

Features

Service

Overall

AO

Andrew Omalley

Andrew is a freelance writer who has been crafting valuable pieces of content relating to personal finance for more than five years. Previously, he studied Economics & Finance at university and he has professional qualifications relating to financial advice.

We make the best effort to present up-to-date information; however, the terms of each offer can be revised according to the service provider’s discretion. The above shall not be considered as an expert or professional advice for any matter.

Clear, monthly pricing

Clear, monthly pricing

Expensive for low sales volume businesses

Expensive for low sales volume businesses

Write a review

Write a review

Thank you!